INTRO -:

Financial crises have repeatedly shaped economies, altered political landscapes, and transformed societies throughout history. These economic disasters often follow similar patterns of excessive optimism, speculative bubbles, and eventual collapse, yet each has its unique characteristics and lasting impacts.

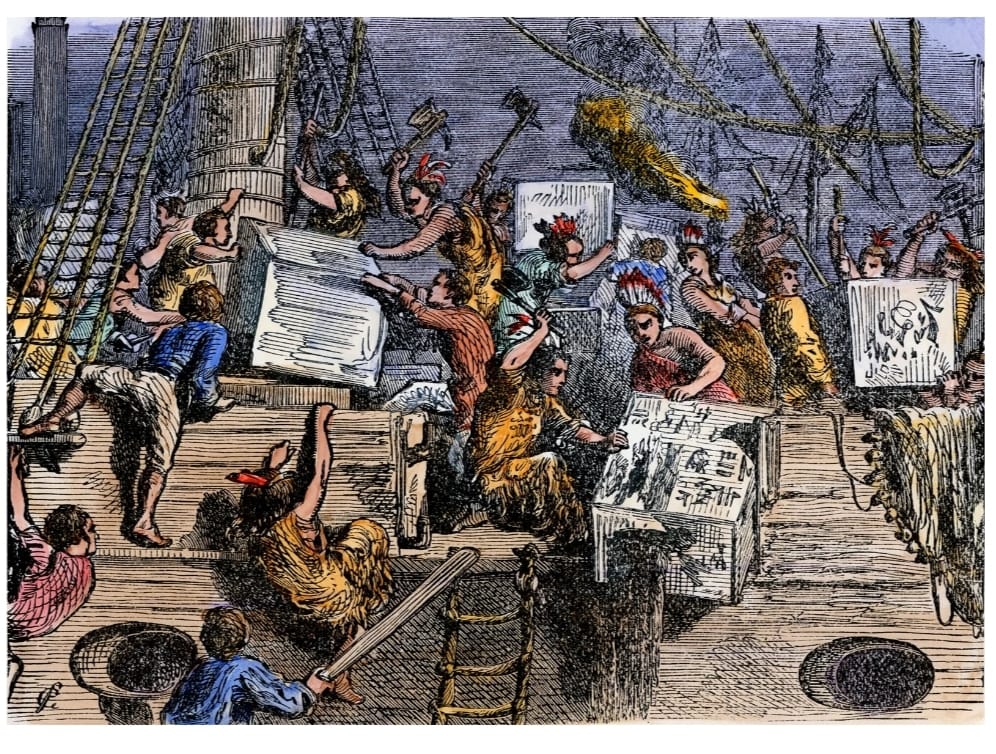

The Credit Crisis of 1772

One of the earliest documented financial crises began in London and rapidly spread across Europe and the American colonies.

Causes:

Excessive wealth accumulation in the British Empire through colonial trade

Period of rapid credit expansion by British banks

Overoptimism in the banking sector

Trigger Event: On June 8, 1772, Alexander Fordyce, a partner of the British banking house Neal, James, Fordyce, and Down, fled to France to escape debt repayments. This news triggered immediate bank runs as creditors formed long lines at British banks demanding cash withdrawals.

Impact and Significance:

Rapid spread to Scotland, Netherlands, and British American colonies

Historians believe this crisis contributed significantly to the Boston Tea Party protests

Considered a contributing factor to the American Revolution

The economic disruption from this crisis helped create the conditions for political revolution, showing how financial instability can have profound historical consequences. Source

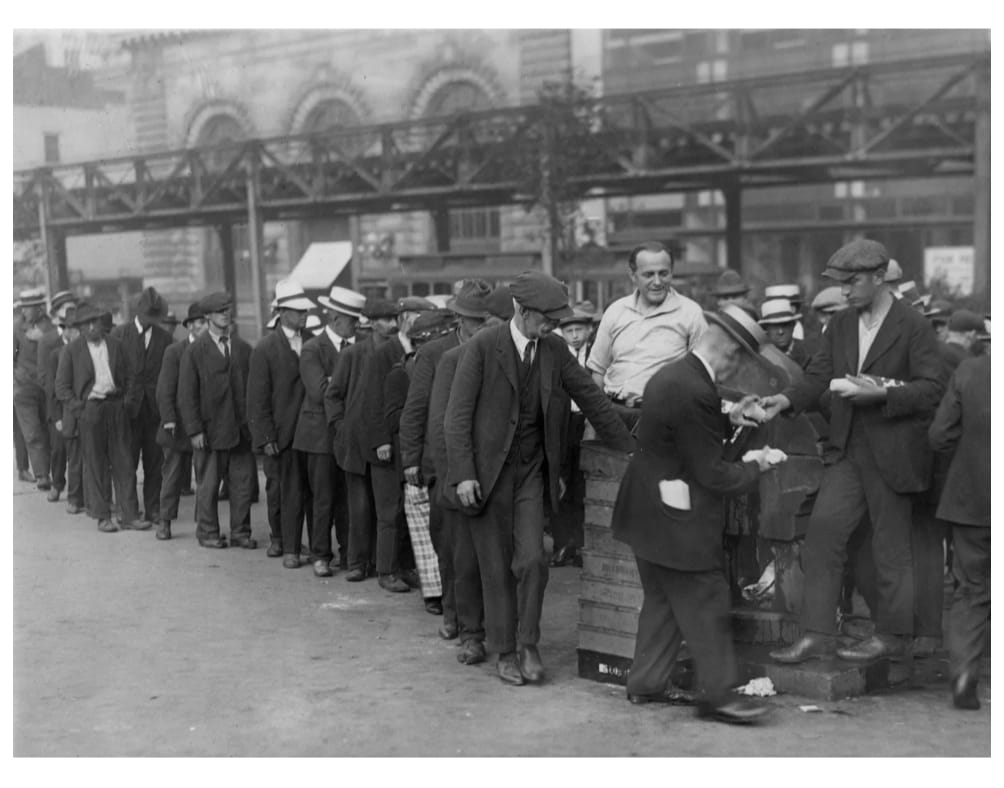

The Great Depression (1929- 1939)

The Great Depression was the worst economic disaster of the 20th century and remains the benchmark against which all other financial crises are measured.

Causes:

Stock market speculation during the “Roaring Twenties”

Excessive use of margin trading (buying stocks with borrowed money)

Weak banking regulations and structure

Contractionary monetary policy

Agricultural overproduction and falling prices

Trigger Event: The Wall Street Crash of 1929, starting with “Black Thursday” (October 24) and continuing through “Black Tuesday” (October 29), when the market lost over 25% in just two days.

Impact and Severity:

U.S. GDP fell by approximately 30% between 1929 and 1933

U.S. unemployment reached nearly 25% at its peak in 1933

Thousands of banks failed across the country

Global trade declined by roughly 65%

Deflation caused prices to plummet, increasing the real value of debts

Agricultural prices collapsed, devastating rural communities

Global spread affected economies worldwide for a decade

Legacy and Reforms:

Creation of the Securities and Exchange Commission (SEC)

Establishment of the FDIC to insure bank deposits

Glass-Steagall Act separating commercial and investment banking

Introduction of Social Security and unemployment insurance

Expanded role of government in economic management through New Deal programs

The Depression fundamentally altered the relationship between government and the economy in most developed nations and laid the groundwork for modern economic policies and institutions. Source

The OPEC Oil Price Shock of 1973

This crisis marked the first major global economic disruption driven by energy politics and resource control.

Causes:

Political tension between OPEC nations and Western powers

U.S. support for Israel during the Fourth Arab-Israeli War (Yom Kippur War)

Growing dependency of developed economies on oil imports

Trigger Event: OPEC member countries (primarily Arab nations) declared an oil embargo against the United States and its allies, abruptly halting oil exports.

Impact:

Severe oil shortages in the U.S. and allied countries

Oil prices quadrupled from approximately $3 to $12 per barrel

Created the unique economic phenomenon of “stagflation” (simultaneous high inflation and economic stagnation)

U.S. GDP declined by 3.2% during the ensuing recession

Inflation reached double digits in many developed countries

Unemployment increased substantially across affected economies

Exposed the vulnerability of industrialized nations to energy supply disruptions

Legacy:

Spurred development of energy conservation policies

Increased interest in alternative energy sources

Led to creation of strategic petroleum reserves in many countries

Fundamentally changed thinking about energy security

Highlighted the political dimension of economic interdependence

This crisis demonstrated how resource dependencies could be weaponized, forever changing the relationship between energy, economics, and geopolitics. Source

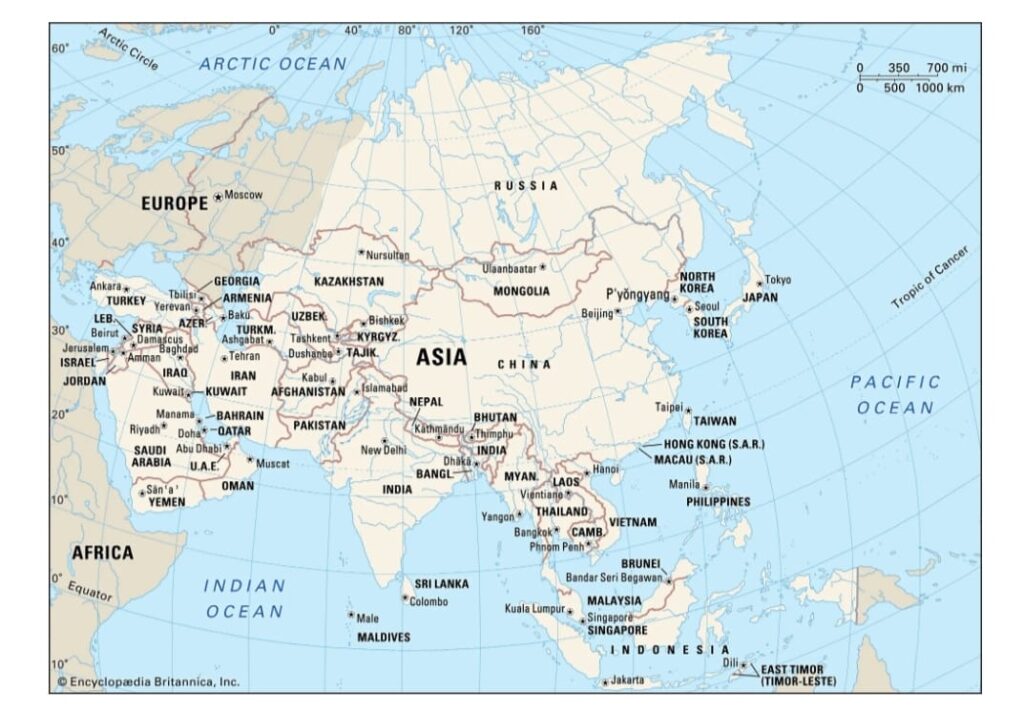

The Asian Financial Crisis of 1997

This crisis began in Thailand and rapidly engulfed East Asian economies that had previously been celebrated as “Asian Tigers” for their rapid growth and development.

Causes:

Excessive speculative capital flows from developed countries to East Asian economies

Overextension of credit and accumulation of excessive debt

Fixed exchange rates that became unsustainable

Inadequate financial sector regulation

Current account deficits and foreign-denominated debt

Trigger Event: In July 1997, the Thai government abandoned its fixed exchange rate against the U.S. dollar due to lack of foreign currency reserves, causing the Thai baht to collapse

Spread and Impact:

Quickly spread to Indonesia, Malaysia, Philippines, South Korea, and Hong Kong

Widespread reversal of billions of dollars in foreign investment

Currency collapses across the region (Indonesian rupiah lost 80% of its value)

Deep economic contractions (Thailand’s economy shrank by 10.5%)

Social and political instability (including the fall of Indonesia’s Suharto regime)

Dramatic increase in poverty and unemployment

Required massive IMF bailout packages totaling over $40 billion

Recovery and Lessons:

Exposed the risks of rapid financial liberalization without adequate oversight

Led to widespread reforms in banking regulations across Asia

Prompted Asian countries to build massive foreign exchange reserves as protection

Many affected countries eventually emerged stronger with more resilient financial systems

Created lasting skepticism toward IMF policies in the region

This crisis demonstrated how quickly investor sentiment could shift and revealed the vulnerabilities created by global capital flows in emerging markets. Source

The Dot-Com Bubble (1995-2001)

The dot-com bubble represented the first major financial crisis centered around the internet economy and new technology.

Causes:

Excessive speculation in internet-related companies

Massive venture capital investments in startups with no clear path to profitability

Widespread belief that traditional business metrics didn’t apply to internet companies

Low interest rates encouraging risky investments

Market psychology of “fear of missing out” on the next big tech success

Bubble Growth:

The NASDAQ Composite index rose from around 1,000 in 1995 to over 5,000 by March 2000

Many internet companies reached multi-billion dollar valuations with minimal revenue

IPOs of tech companies commonly saw first-day price increases of over 100%

Investment in internet infrastructure expanded dramatically

Burst and Impact:

The bubble peaked on March 10, 2000, when the NASDAQ reached 5,048.62

By October 2002, the NASDAQ had fallen to 1,114, a 78% drop from its peak

Approximately $5 trillion in market value was erased

Thousands of dot-com companies failed

Significant job losses in the technology sector

Venture capital investment contracted dramatically

Led to a mild recession in 2001

Notable Failures:

Pets.com (spent millions on advertising but collapsed just 9 months after its IPO)

Webvan (online grocer that burned through $800 million before failing)

Boo.com (fashion retailer that spent $188 million in just 6 months)

eToys.com (reached $10 billion market cap but went bankrupt when sales disappointed)

Survivors: Companies that survived the crash, like Amazon, eBay, and Google, became the foundation of the modern internet economy. They generally had stronger business fundamentals, manageable cash burn rates, or were able to adapt quickly. Source

The Financial Crisis of 2007-2008 & Great Recession

This crisis represents the most severe global financial disaster since the Great Depression, with far-reaching consequences that continue to shape economic policies today.

The Financial Crisis of 2007-2008 & Great Recession

This crisis represents the most severe global financial disaster since the Great Depression, with far-reaching consequences that continue to shape economic policies today.

Causes:

Subprime mortgage lending to borrowers with poor credit history

Complex financial innovations (mortgage-backed securities, CDOs)

Excessive risk-taking by financial institutions

Inadequate regulatory oversight

Credit rating agencies failing to accurately assess risk

Global imbalances in capital flows

Record levels of household debt

Key Events:

Housing bubble burst (2006-2007)

BNP Paribas froze three investment funds (August 2007)

Bear Stearns collapse and JP Morgan acquisition (March 2008)

Lehman Brothers bankruptcy (September 15, 2008)

AIG bailout ($182 billion)

Global credit freeze and stock market crash

Government bailouts of major financial institutions worldwide

Impact:

U.S. GDP contracted by 4.3% from peak to trough

U.S. unemployment reached 10%

Housing prices declined by over 30% nationally

Approximately 8.7 million jobs lost in the U.S.

$19.2 trillion in household wealth destroyed

Foreclosures affected over 6 million American households

Global trade collapsed by over 15%

Triggered European sovereign debt crisis

Policy Responses:

Unprecedented central bank interventions (quantitative easing)

Government stimulus packages (American Recovery and Reinvestment Act)

Troubled Asset Relief Program (TARP)

Dodd-Frank Wall Street Reform and Consumer Protection Act

Creation of the Financial Stability Board

Basel III capital requirements for banks

Macroprudential regulation to address systemic risk

The 2008 crisis fundamentally changed attitudes toward financial regulation, central banking, and government intervention in markets. Its effects on politics, inequality, and public trust in institutions continue to resonate. Source

The COVID-19 Pandemic Economic Crisis (2020-2021)

The COVID-19 crisis represented a unique economic shock triggered by a global health emergency rather than financial imbalances.

Causes:

Global pandemic requiring widespread lockdowns and business closures

Supply chain disruptions on an unprecedented scale

Collapse in consumer demand for services requiring in-person interaction

Extreme uncertainty about economic outlook

Unique Characteristics:

Government-mandated economic shutdowns to protect public health

Simultaneous supply and demand shocks

Extremely rapid onset (weeks rather than months)

Disproportionate impact by sector (services vs. goods)

Unprecedented policy response in speed and scale

Impact:

Global GDP contracted by 3.3% in 2020

U.S. unemployment rate spiked to 14.8% in April 2020

22 million U.S. jobs lost in just two months

Service industries (hospitality, travel, entertainment) devastated

Dramatic acceleration of digital transformation and remote work

Supply chain disruptions led to shortages and price increases

U.S. poverty increased for first time in a generation

Disproportionate impact on women, minorities, and low-wage workers

Policy Response:

Over $10 trillion in global fiscal support

Central banks cut interest rates to zero or negative levels

Massive expansion of quantitative easing programs

Direct payments to households (Economic Impact Payments in U.S.)

Enhanced unemployment benefits

Paycheck Protection Program for businesses

Eviction moratoriums and forbearance programs

Recovery and Legacy:

Fastest recession and recovery in modern history

Created inflation pressures due to supply constraints and stimulus

Accelerated adoption of digital technologies by several years

Transformed workplace norms and remote work expectations

Exposed vulnerabilities in global supply chains

Increased government debt to record levels

Highlighted economic inequalities and vulnerabilities

The COVID-19 crisis demonstrated both the fragility of the global economic system and its remarkable adaptability. It also showed the importance of decisive government action in crisis management. Source

Common Patterns in Financial Crises

Despite their different triggers and contexts, financial crises often follow similar patterns:

Asset Bubbles – Prices of certain assets (stocks, housing, commodities) rise far above their fundamental values

Excessive Leverage – Debt levels increase dramatically, amplifying potential losses

Irrational Exuberance – Market psychology becomes detached from economic fundamentals

Regulatory Failure – Oversight mechanisms fail to identify or address growing risks

Contagion – Problems in one market or region spread rapidly to others

Liquidity Crises – Access to short-term funding suddenly disappears

Deleveraging – Rapid sell-offs and debt reduction exacerbate market declines

Policy Responses – Government and central bank interventions to stabilize markets

Structural Reforms – Changes to regulations and institutions following the crisis

Economic Scarring – Long-term effects on growth, employment, and public confidence

Conclusion

Financial crises are recurring features of economic history, each with unique causes and characteristics but sharing common patterns. Understanding these historical events provides valuable context for interpreting current economic challenges and developing more resilient financial systems.

From the Credit Crisis of 1772 that contributed to the American Revolution to the COVID-19 pandemic that transformed how we work, financial crises have profound and lasting impacts that extend far beyond economics into politics, society, and daily life. While their immediate effects are often devastating, they also frequently lead to important reforms that strengthen financial systems against future shocks.